top of page

CAESAR THE DAY

Search

Borderless Wealth: How to Think (and Invest) Like a European

The first time I walked into an Italian bank, I thought I’d made a wrong turn and ended up in a museum. The marble counters were chipped from the 1960s, the chairs squeaked, and the teller—an older man with a mustache that looked unionized—stamped my form with a satisfying thud that echoed through the room like a declaration of independence. No rush. No digital screens counting my impatience. Just the rhythm of a man who has never once said the words “time is money.” And that

Oct 22, 20255 min read

The 7% Flat Tax in Italy: What It Really Means for Retirees

The 7% flat tax in Italy sounds simple — pay 7% on your pension income and live happily ever after. But once you dig into the details, the picture gets a lot messier. Social Security, IRAs, private pensions, annuities, government pensions, VA benefits, and Roth IRAs are all treated differently under the U.S.–Italy tax treaty.

Sep 15, 20256 min read

Do You Need an Italian Bank Account - Or Is Wise Enough?

Thinking of retiring or relocating to Italy? Here’s when a Wise or Revolut account is enough — and when you’ll need to bite the bullet and open a real Italian bank account. We compare fees, IBANs, utilities, and bureaucracy-proofing your finances.

Aug 1, 20253 min read

Why Cutting State Tax Ties Matters (Even If You’re Leaving the U.S.)

Think moving abroad means you’re done paying U.S. state taxes? Think again.

If you’re leaving California, New York, or another high-tax state, you need more than a plane ticket—you need a paper trail that proves you’re gone for good. From surrendering your driver’s license to scrubbing your digital footprint, this guide breaks down how to legally and permanently cut tax ties before you move abroad.

Jun 3, 20257 min read

Understanding Italy's Taxation on U.S. Retirement Accounts

If you’re retiring in Italy with U.S. retirement accounts, read this first. Learn how Italy taxes IRAs, Roth IRAs, and 401(k)s, how the U.S.-Italy tax treaty works, and what to expect under Italy’s progressive and 7% flat tax regimes.

May 20, 20253 min read

Why the 4% Rule Doesn’t Work for Retiring Abroad

You’re not just retiring abroad — you’re exiting a financial system that’s being reshaped in real time by tariffs, currency shocks, and political volatility. The 4% rule wasn’t built for this world. Pretending it still works isn’t optimism — it’s negligence.

May 13, 20255 min read

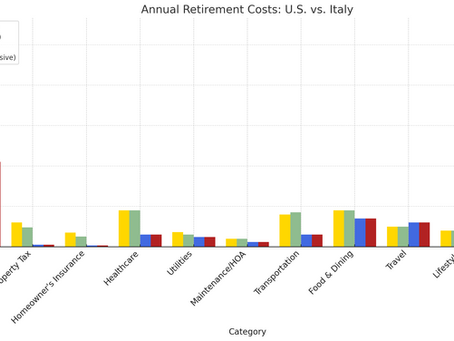

Retirement Reality: U.S. vs. Italy - Because Numbers Don't Lie

Most Americans worry about taxes or salaries abroad — but what really matters is survival. Here’s the financial reality behind our decision to retire in Italy, with real numbers comparing U.S. vs Italy costs, healthcare, taxes, and long-term security.

Apr 28, 20255 min read

Retiring Smart: U.S. vs. Italy (7% Flat Tax Scheme vs. Progressive Tax)

A no-fluff breakdown of Italy’s 7% flat tax vs. U.S. retirement costs—real math, smart strategy, and what happens after year 10.

Apr 3, 202515 min read

bottom of page